Avenova® sales increase 9% and operating expenses decline 47% over the 2019 first quarter

Conference call to be held Thursday August 8, 2019 at 4:30 p.m. Eastern time

EMERYVILLE, Calif. (August 7, 2019) – NovaBay® Pharmaceuticals, Inc. (NYSE American: NBY), a biopharmaceutical company focusing on commercializing Avenova for the domestic eye care market, reports financial results for the three and six months ended June 30, 2019 and provides a business update.

“We are having success with our strategy to increase Avenova sales through various channels that address the negative impact of high-deductible health plans on unit sales and gross-to-net revenue,” said Justin Hall, President and CEO. “Avenova sales for the 2019 second quarter of $1.6 million increased 9% over the first quarter while operating expenses decreased 47%.

“Avenova sales through our prescription channel increased 7% over the first quarter despite the 67% reduction in the size of our salesforce in March. We achieved this growth by deploying our remaining sales representatives in high-volume territories with favorable reimbursement, while doubling the number of pharmacies in our partner pharmacy program. We sell Avenova to our pharmacy partners at pre-negotiated prices, and about 52% of all prescription units were sold through these channel partners in the second quarter, up from about 38% in the first quarter of 2019. Additionally, we launched Avenova Direct on Amazon.com in June to improve patient access to the product and expand our reach into a broader marketplace.

“Beyond just Avenova, we are preparing another direct-to-consumer launch for late 2019 with our product for aesthetic dermatology, CelleRx®. This unique topical solution based on our pure hypochlorous formulation is especially designed to gently clean and ease discomfort following cosmetic procedures, and targets a large global market opportunity,” he added.

Second Quarter Financial Results

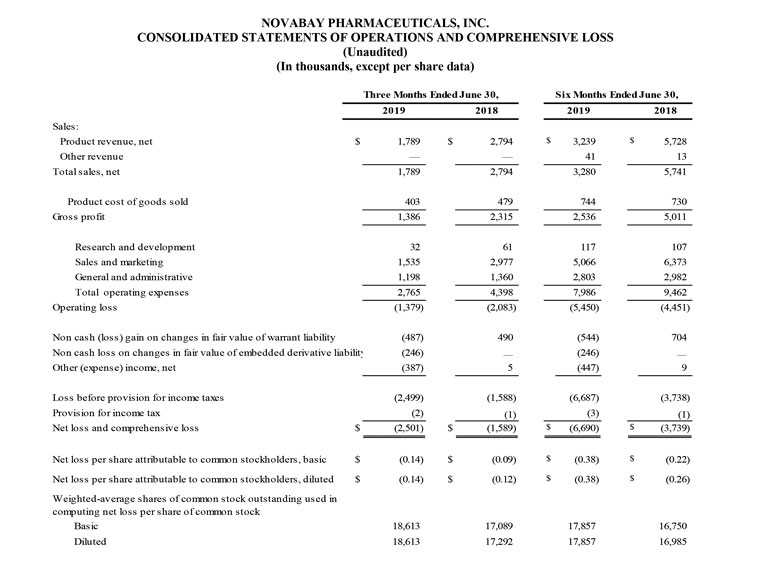

Net sales for the second quarter of 2019 were $1.8 million and included $1.6 million in Avenova sales and $0.2 million for a stocking order for NeutroPhase® to China Pioneer Pharma Holdings. Net sales were $2.8 million for the second quarter of 2018. The decrease was due to lower Avenova unit sales and lower gross-to-net pricing. Gross margin on net product revenue was 77% for the second quarter of 2019 compared with 83% for the prior-year period, with the decrease due to lower product revenue.

Operating expenses for the second quarter of 2019 were $2.8 million, a 37% decline from $4.4 million in the second quarter of 2018, reflecting the strategic shift in the U.S. commercial organization in March 2019. Sales and marketing expenses for the second quarter of 2019 were $1.5 million, a 48% decrease from $3.0 million for the second quarter of 2018. General and administrative expenses for the second quarter of 2019 were $1.2 million, a 12% decrease from $1.4 million for the second quarter of 2018. Research and development expenses for the second quarter of 2019 were $32,000 compared with $61,000 for the second quarter of 2018.

Operating loss for the second quarter of 2019 was $1.4 million, a 34% improvement from the operating loss of $2.1 million for the second quarter of 2018.

Non-cash loss on the change of fair value of warrant liability for the second quarter of 2019 was $0.5 million compared with a non-cash gain of $0.5 million for the second quarter of 2018.

Non-cash loss on the embedded derivative associated with the convertible note for the second quarter of 2019 was $0.2 million. The Company did not record a comparable loss or gain for the second quarter of 2018.

Other expense for the second quarter of 2019 was $0.4 million compared with other income of $5,000 for the second quarter of 2018. The other expense in 2019 was due to interest due on the Promissory Note issued in February 2019 and the amortization of discount and issuance cost related to the Convertible Note issued in March 2019.

The net loss for the second quarter of 2019 was $2.5 million, or $0.14 per share, compared with a net loss for the second quarter of 2018 of $1.6 million, or $0.09 per share.

Six Month Financial Results

Net sales for the six months ended June 30, 2019 were $3.3 million compared with $5.7 million for the six months ended June 30, 2018. Gross margin on net product revenue was 77% for the first half of 2019 compared with 87% for the first half of 2018.

For the six months ended June 30, 2019, sales and marketing expenses decreased 21% to $5.1 million, general and administrative expenses decreased 6% to $2.8 million and research and development expenses increased 9% to $117,000, all compared with the six months ended June 30, 2018.

Non-cash loss on the change of fair market of warrant liability for the first six months of 2019 was $0.5 million compared with a non-cash gain of $0.7 million for the first six months of 2018.

Non-cash loss on the embedded derivative associated with the Convertible Note for the first six months of 2019 was $0.2 million. The Company did not record a comparable loss or gain for the first six months of 2018.

Other expense for the first six months of 2019 was $0.5 million compared with other income of $9,000 for the same period of 2018. The other expense was due to interest due on the Promissory Note issued in February 2019 and the amortization of discount and issuance cost related to the Convertible Note issued in March 2019.

The net loss for the six months ended June 30, 2019 was $6.7 million, or $0.38 per share, compared with a net loss for the six months ended June 30, 2018 of $3.7 million, or $0.22 per share.

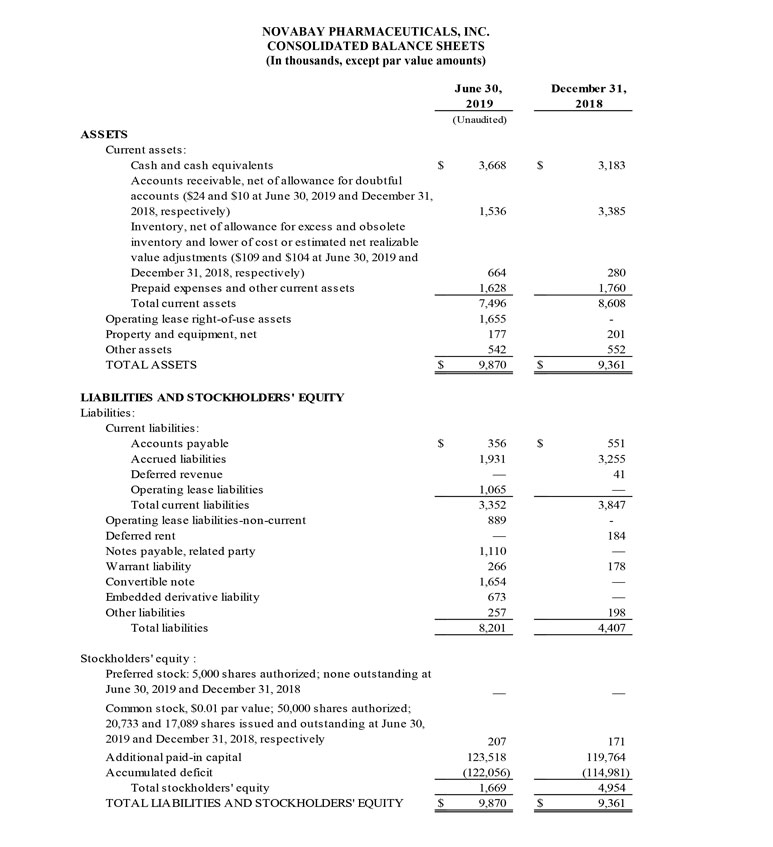

NovaBay reported cash and cash equivalents of $3.7 million as of June 30, 2019 compared with $3.2 million as of December 31, 2018. The Company raised $1.0 million through a related-party loan in February, $2.0 million through a convertible loan in March, and $0.4 million in May and $2.4 million in June through private placements of common stock.

Conference Call

NovaBay management will host an investment community conference call on Thursday August 8, 2019 beginning at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss the Company’s financial and operational results and to answer questions. Shareholders and other interested parties may participate in the conference call by dialing 800-608-8202 from within the U.S. or 702-495-1913 from outside the U.S., with the conference identification number 6067542.

A live webcast of the call will be available at http://novabay.com/investors/events and will be archived for 90 days. A replay of the call will be available beginning two hours after call ends through 11:59 p.m. Eastern time August 26, 2019 by dialing 855-859-2056 from within the U.S. or 404-537-3406 from outside the U.S. and entering the conference identification number 6067542.

About Avenova®

Avenova is an eye care product formulated with our proprietary, stable and pure form of hypochlorous acid. Avenova is designed for removal of the microorganisms and debris that contribute to conditions such as meibomian gland dysfunction, dry eye and blepharitis. Avenova is marketed to optometrists and ophthalmologists throughout the U.S. by NovaBay’s direct salesforce and available online direct-to-consumer through Amazon.com.

About NovaBay Pharmaceuticals, Inc.: Going Beyond Antibiotics®

NovaBay Pharmaceuticals, Inc. is a biopharmaceutical company focusing on commercializing and developing its non-antibiotic anti-infective products to address the unmet therapeutic needs of the global, topical anti-infective market with its two distinct product categories: the NEUTROX® family of products and the AGANOCIDE® compounds. The Neutrox family of products includes AVENOVA® for the eye care market, NEUTROPHASE® for wound care market, and CELLERX® for the aesthetic dermatology market. The Aganocide compounds, still under development, have target applications in the dermatology and urology markets.

Forward-Looking Statements

This release contains forward-looking statements that are based upon management’s current expectations, assumptions, estimates, projections and beliefs. These statements include, but are not limited to, statements regarding our business strategies and future focus, our estimated future revenue, and generally the Company’s expected future financial results. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or achievements to be materially different and adverse from those expressed in or implied by the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, risks and uncertainties relating to the size of the potential market for our products, improving sales rep productivity and product distribution, obtaining adequate insurance reimbursement, and any potential regulatory problems. Other risks relating to NovaBay’s business, including risks that could cause results to differ materially from those projected in the forward-looking statements in this press release, are detailed in NovaBay’s latest Form 10-Q/K filings with the Securities and Exchange Commission, especially under the heading “Risk Factors.” The forward-looking statements in this release speak only as of this date, and NovaBay disclaims any intent or obligation to revise or update publicly any forward-looking statement except as required by law.

Socialize and Stay informed on NovaBay’s progress:

Like us on Facebook

Follow us on Twitter

Connect with NovaBay on LinkedIn

Join us on Google+

Visit NovaBay’s Website

For NovaBay Avenova purchasing information:

Please Call us toll free: 1-800-890-0329 or email sales@avenova.com.

www.Avenova.com

NovaBay Contact

Justin Hall

President and Chief Executive Officer

510-899-8800

jhall@novabay.com

Investor Contact

LHA

Jody Cain

310-691-7100

jcain@lhai.com