- Fourth quarter net product revenue increased 40% on record Avenova spray unit sales

- 2021 Avenova spray net revenue increased 15% on 31% growth in unit sales

- 2020 net product revenue boosted by $3.1 million in non-recurring PPE product sales

- Company executing on growth strategy with DERMAdoctor acquisition

Conference call begins at 4:30 p.m. Eastern time today

EMERYVILLE, Calif. (March 29, 2022) – NovaBay® Pharmaceuticals, Inc. (NYSE American: NBY) reports financial results for the three and 12 months ended December 31, 2021 and provides a business update. Financial results include the operations of the acquired DERMAdoctor business beginning November 5, 2021.

“NovaBay closed out an eventful year on a high note with fourth quarter net product revenue increasing 40% over the prior-year period on record Avenova spray unit sales,” said Justin Hall, NovaBay CEO. “Avenova spray sales for 2021 increased 15% with unit sales up 31% as more people than ever purchased our antimicrobial lid and lash spray. Importantly, 74% of Avenova net product revenue in 2021 was through non-prescription channels, driven by our innovative direct-to-consumer marketing.

“During the fourth quarter we completed our acquisition of DERMAdoctor, successfully transforming NovaBay from a single-product company to one with strong footholds in the large and growing eyecare and skincare markets. Our focus is firmly on growing NovaBay and DERMAdoctor product sales through a multipronged strategy including product diversification and international distribution,” added Mr. Hall. “Since the start of 2022, we expanded our Avenova product portfolio with lubricating eye drops that feature a mode of action that’s new to the eyecare market, and added a newly formulated hydrating hyaluronic acid serum to our DERMAdoctor Calm Cool + Corrected collection. Both products are scientifically formulated to be highly effective, yet gentle, and were launched under our cost-efficient commercial model. We also engaged a new marketing firm to increase consumer exposure to DERMAdoctor products in China’s vast online market.

“Our plans to drive continued sales growth feature the commercialization of new products throughout the year under both the Avenova and DERMAdoctor brands. Very soon we will be entering a new, largely untapped segment of the cosmetic eyecare market that will allow us to capitalize on cross-selling opportunities afforded by a demographic overlap with DERMAdoctor customers,” said Mr. Hall. “We are well positioned to execute on these opportunities with capital resources we believe are sufficient to fund planned operations for the next year and beyond.”

Fourth Quarter Financial Results

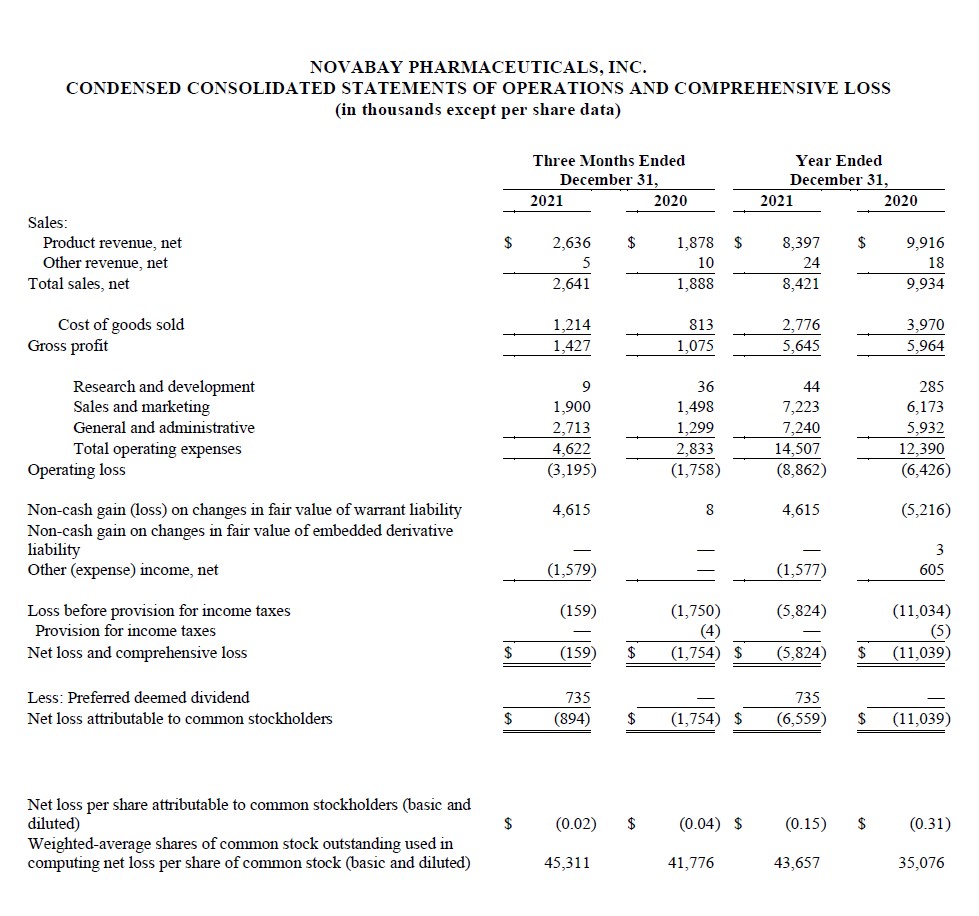

Net product revenue for the fourth quarter of 2021 was $2.6 million, an increase of 40% from the prior-year period, and consisted of $1.6 million in Avenova spray sales, $0.6 million of DERMAdoctor product sales, and $0.4 million in sales of PhaseOne® and NeutroPhase® wound care products and other Avenova branded products. For the fourth quarter of 2021, total Avenova spray unit sales increased 13% compared with the prior-year period, with on-line unit sales increasing 29%. For the fourth quarter of 2020, net product revenue was $1.9 million, and consisted of $1.5 million in Avenova sales and $0.4 million in NeutroPhase sales.

Gross margin on net product revenue for the fourth quarter of 2021 was 54%, compared with 57% for the fourth quarter of 2020, with the decrease primarily due to a reduction in the portion of net product revenue from the higher margin pharmacy channels.

Operating expenses for the fourth quarter of 2021 were $4.6 million, compared with $2.8 million for the fourth quarter of 2020, with a majority of the increase due to one-time expenses associated with the DERMAdoctor acquisition and related financing. Sales and marketing expenses were $1.9 million, compared with $1.5 million a year ago, with the increase due to an increase in marketing costs for Avenova branded products, primarily digital advertising. The 2021 period also includes $0.2 million in DERMAdoctor sales and marketing costs incurred after completion of the acquisition in the fourth quarter. These cost increases were partially offset by savings from a lower number of field sales headcount employed in the 2021 period. General and administrative (G&A) expenses were $2.7 million, compared with $1.3 million for the fourth quarter of 2020, with the increase due primarily to nonrecurring costs associated with the DERMAdoctor acquisition and private placement financing completed in the fourth quarter of 2021. The 2021 fourth quarter also includes $0.3 million in DERMAdoctor G&A costs incurred after completion of the acquisition. Research and development (R&D) expenses for the fourth quarter of 2021 were $9 thousand, compared with $36 thousand for the prior-year period.

Non-cash gain on changes in fair value of warrant liability for the fourth quarter of 2021 was $4.6 million, compared with a non-cash gain of $8 thousand for the prior-year period.

Other expense, net for the fourth quarter of 2021 was $1.6 million, representing issuance costs related to the warrants issued in conjunction with the financing completed in the fourth quarter of 2021. There was no other income or expense, net recorded for the fourth quarter of 2020.

Net loss attributable to common stockholders for the fourth quarter of 2021 was $0.9 million, or $0.02 per share, compared with net loss attributable to common stockholders for the fourth quarter of 2020 of $1.8 million, or $0.04 per share.

Full Year Financial Results

Net product revenue for 2021 was $8.4 million, compared with $9.9 million for 2020. The 2020 period included $3.1 million in sales of KN95 masks and other PPE products with no comparable revenue in the 2021 period. Avenova spray sales for 2021 were $6.8 million, a 15% increase from $6.0 million for 2020. Total Avenova spray unit sales for 2021 increased 31% with on-line unit sales increasing 45%, both compared with 2020.

Gross margin on net product revenue for 2021 was 67%, compared with 60% for 2020.

Sales and marketing expenses for 2021 increased by 17% to $7.2 million, G&A expenses increased by 22% to $7.2 million and R&D expenses decreased by 85% to $44 thousand, all compared with 2020.

Non-cash gain on the change of fair value of warrants for 2021 was $4.6 million, compared with a non-cash loss on the change of fair value of warrant liability for 2020 of $5.2 million.

Other expenses, net for 2021 was $1.6 million, compared with other income, net for 2020 of $0.6 million.

Net loss attributable to common stockholders for 2021 decreased significantly to $6.6 million, or $0.15 per share, compared with net loss attributable to common stockholders for 2020 of $11.0 million, or $0.31 per share.

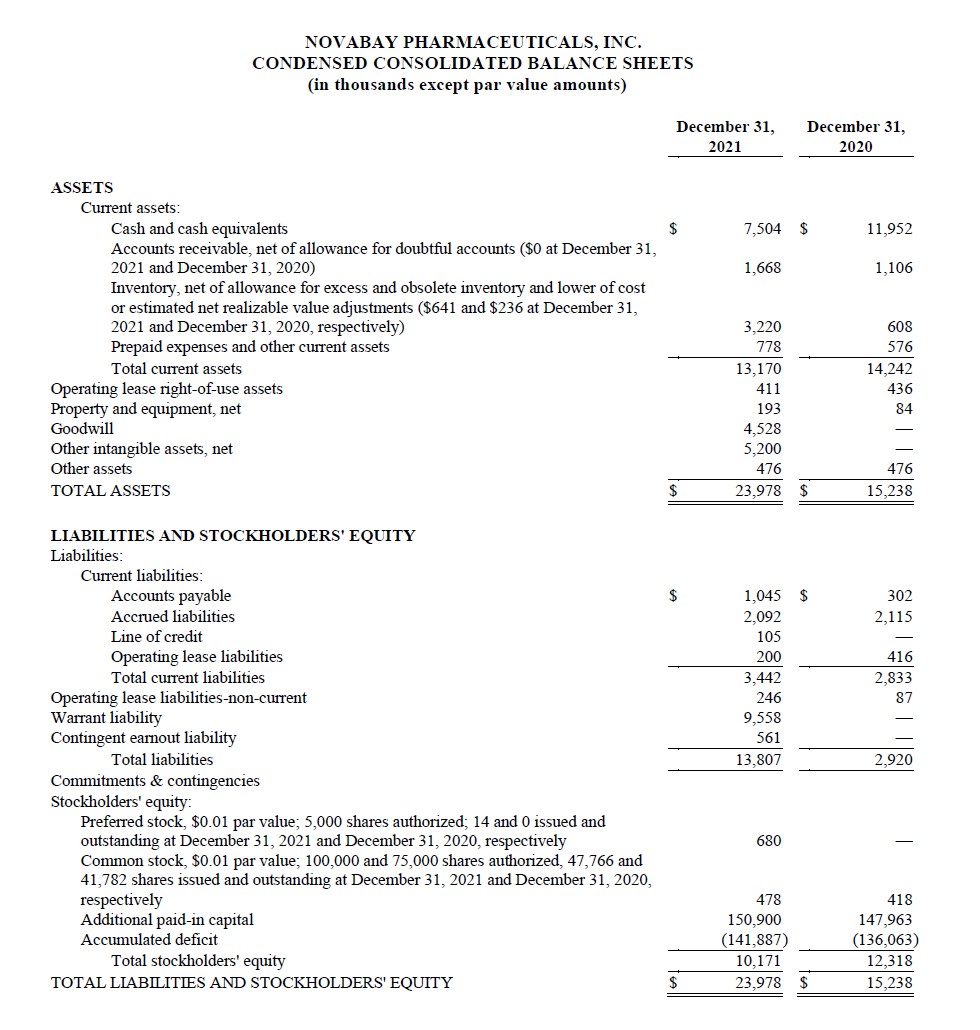

NovaBay had cash and cash equivalents of $7.5 million as of December 31, 2021, compared with $12.0 million as of December 31, 2020. During 2021 the Company received proceeds from a private placement financing as well as an ATM facility.

Conference Call

NovaBay management will host an investment community conference call today beginning at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss the Company’s financial and operational results and to answer questions. Shareholders and other interested parties may participate in the conference call by dialing 866-777-2509 from within the U.S. or 412-317-5413 from outside the U.S., and requesting the NovaBay Pharmaceuticals call.

A live webcast of the call will be available at http://novabay.com/investors/events and will be archived for 90 days. A replay of the call will be available beginning two hours after the call ends through April 14, 2022 by dialing 877-344-7529 from within the U.S., 855-669-9658 from Canada or 412-317-0088 from outside the U.S., and entering the conference identification number 1992038.

About NovaBay Pharmaceuticals, Inc:

NovaBay Pharmaceuticals, Inc. is a pharmaceutical company that develops and sells scientifically created and clinically proven consumer products for the eyecare and skincare markets. Avenova® is the most prescribed antimicrobial lid and lash spray and CelleRx® is a breakthrough product in the beauty category. In November 2021, NovaBay acquired DERMAdoctor, LLC, a company offering more than 30 dermatologist-developed skincare products sold through traditional domestic retailers, digital beauty channels and international distributors.

Forward-Looking Statements

Except for historical information herein, matters set forth in this press release are forward-looking within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including statements about the commercial progress, the transaction in which the Company acquired DERMAdoctor and the future integration and performance of DERMAdoctor, potential opportunities for revenue accretion and future financial performance of NovaBay Pharmaceuticals, Inc. This release contains forward-looking statements that are based upon management’s current expectations, assumptions, estimates, projections and beliefs. These statements include, but are not limited to, statements regarding our business strategies and current product offerings, potential future product offerings including through strategic acquisitions, such as the acquisition of DERMAdoctor, or licensing opportunities, expanded access to our products, and any future revenue that may result from selling these products, as well as generally the Company’s expected future financial results. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or achievements to be materially different and adverse from those expressed in or implied by the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, risks and uncertainties relating to the integration of DERMAdoctor’s business with the Company’s business, the size of the potential market for our products, the possibility that the available market for the Company’s products will not be as large as expected, the Company’s products will not be able to penetrate one or more targeted markets, and revenues will not be sufficient to meet the Company’s cash needs. Other risks relating to NovaBay’s business, including risks that could cause results to differ materially from those projected in the forward-looking statements in this press release, are detailed in NovaBay’s latest Form 10-Q/K filings as well as the Company’s Preliminary Proxy Statement filing with the Securities and Exchange Commission, especially under the heading “Risk Factors.” The forward-looking statements in this release speak only as of this date, and NovaBay disclaims any intent or obligation to revise or update publicly any forward-looking statement except as required by law.

Socialize and Stay Informed on NovaBay’s Progress

Like us on Facebook

Follow us on Twitter

Connect with NovaBay on LinkedIn

Visit NovaBay’s Website

Avenova Purchasing Information

For NovaBay Avenova purchasing information:

Please call 800-890-0329 or email sales@avenova.com

Avenova.com

DERMAdoctor Purchasing Information

For DERMAdoctor purchasing information:

Please call 877-337-6237 or email service@dermadoctor.com

DERMAdoctor.com

NovaBay Contact

Justin Hall

Chief Executive Officer and General Counsel

510-899-8800

jhall@novabay.com

Investor Contact

LHA Investor Relations

Jody Cain

310-691-7100

jcain@lhai.com

Financial tables to follow