Conference call begins at 4:30 p.m. Eastern time today

EMERYVILLE, Calif. (March 26, 2020) – NovaBay® Pharmaceuticals, Inc. (NYSE American: NBY), a biopharmaceutical company focusing on commercializing Avenova® for the domestic eye care market, reports financial results for the three and 12 months ended December 31, 2019 and provides a business update.

“We exited 2019 with fourth quarter Avenova unit sales at their highest level of the year, with momentum being driven by consumer sales on Amazon.com,” said Justin Hall, President and CEO of NovaBay Pharmaceuticals. “Revenue and unit sales from this channel increased each successive month since our online launch in June. By the fourth quarter, 35% of Avenova revenue and 48% of Avenova units were from Amazon.com, up from 21% and 36%, respectively, from the third quarter. While we are pleased with the results from this channel, units through Amazon.com are sold at lower gross-to-net pricing than those sold through the prescription channel, resulting in a year-over-year revenue decline for fourth quarter. Given industrywide issues with prescription reimbursement that have impacted Avenova, and the greater accessibility and improved patient experience from online sales, we view the consumer channel as the greatest opportunity for future Avenova growth.

“Our strategy this year is to enhance shareholder value by cost-effectively expanding our Avenova customer base, while leveraging our online and buy-and-sell channels with complementary product offerings and line extensions,” said Mr. Hall. “As online consumer sales become an increasing percentage of total sales of our Avenova business, we are introducing new consumer branding, with reinvigorated quality-of-life messaging and appealing packaging aimed at attracting new consumers, as now seen on Avenova.com. This refreshed branding, which highlights the ease in which Avenova can fit into people’s daily routines, is designed to appeal to a broader universe of consumers.”

Fourth Quarter Financial Results

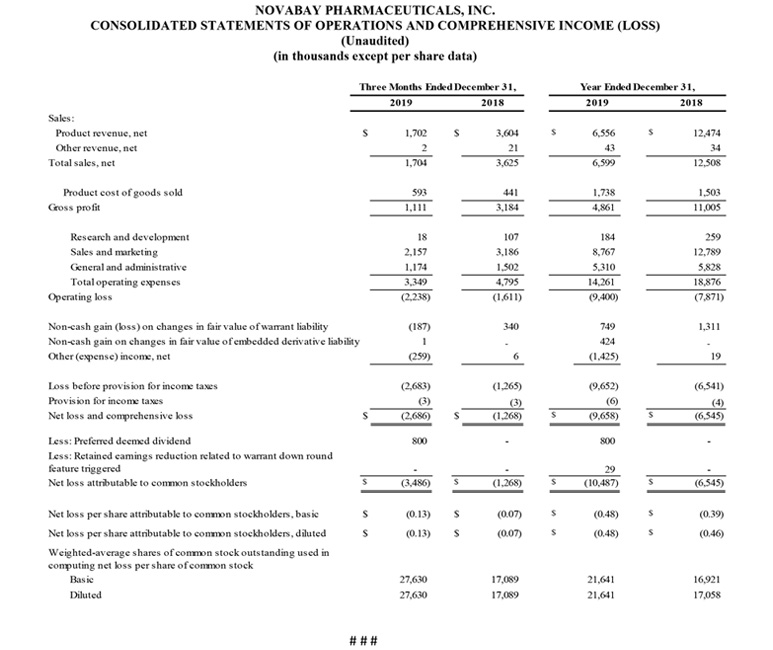

Net sales for the fourth quarter of 2019 were $1.7 million compared with $3.6 million for the fourth quarter of 2018. The decrease in net sales was primarily the result of a decrease in the net selling price of Avenova products, along with a decrease in the number of Avenova units sold, largely due to a decrease in insurance coverage of the product by national payors. In response to this pricing pressure, NovaBay launched Avenova Direct, which although contributing to stabilizing Avenova unit sales in 2019, has a lower net selling price. Gross margin on net product revenue was 65% for the fourth quarter of 2019 compared with 88% for the prior-year period, with the decrease due to lower gross-to-net pricing.

Operating expenses for the fourth quarter of 2019 were $3.3 million, a 30% decrease from $4.8 million in the fourth quarter of 2018, reflecting the strategic shift in the U.S. commercial organization undertaken in March 2019, which included a major salesforce reduction. Sales and marketing expenses for the fourth quarter of 2019 were $2.2 million, a 32% decrease from $3.2 million for the fourth quarter of 2018, with the decrease due to reduced headcount, partly offset by an increase in direct marketing expenses focused on increasing sales of Avenova. General and administrative (G&A) expenses for the fourth quarter of 2019 were $1.2 million, a 22% decrease from $1.5 million for the fourth quarter of 2018. The decrease was due to reduced headcount, offset by severance payments and consulting fees. Research and development (R&D) expenses for the fourth quarter of 2019 were $18,000 compared with $0.1 million for the fourth quarter of 2018.

Non-cash loss on the change of fair value of warrant liability for the fourth quarter of 2019 was $0.2 million compared with a non-cash gain of $0.3 million for the fourth quarter of 2018.

Non-cash gain on the embedded derivative associated with the Convertible Note for the fourth quarter of 2019 was $1,000. The convertible note was issued in March 2019 and the Company did not record a comparable loss or gain for the fourth quarter of 2018.

Other expense for the fourth quarter of 2019 was $0.3 million compared with other income of $6,000 for the fourth quarter of 2018. The other expense in 2019 was due to interest due on the Promissory Note issued in February 2019 and the amortization of discount and issuance cost related to the Convertible Note issued in March 2019.

The Company recorded a beneficial conversion feature of $0.8 million in the fourth quarter of 2019 related to the conversion of 2.7 million shares of perpetual Series A Preferred Stock into 2.7 million shares of common stock. The transaction was recorded as a discount to preferred stock and an increase to additional paid-in capital. The Company recorded no comparable transaction in the fourth quarter of 2018.

The net loss attributed to common stockholders for the fourth quarter of 2019 was $3.5 million, or $0.13 per share, compared with a net loss for the fourth quarter of 2018 of $1.3 million, or $0.07 per share.

Full Year Financial Results

Net sales for 2019 were $6.6 million compared with $12.5 million for 2018. The decrease in net sales was primarily the result of a decrease in the net selling price of Avenova products, along with a decrease in the number of Avenova units sold, largely due to a decrease in insurance coverage of the product by national payors. In response to this pricing pressure, NovaBay launched Avenova Direct, which although contributing to stabilizing Avenova unit sales in 2019, has a lower net selling price. Gross margin on net product revenue was 74% for 2019 compared with 88% for 2018, with the decrease due to lower gross-to-net pricing.

Operating expense for 2019 was $14.3 million, a 24% decrease from $18.9 million in 2018. Sales and marketing expenses for 2019 were $8.8 million, a 31% decrease from $12.8 million for 2018, with the decrease due to reduced sales representative headcount, partly offset by an increase in direct marketing expenses. G&A expenses for 2019 were $5.3 million, an 9% decrease from $5.8 million for 2018, with the decrease due to reduced headcount, offset by severance payments and consulting fees. R&D expenses for 2019 were $184,000 compared with $259,000 for 2018, with the decrease primarily due to the strategic shift of capital resources from R&D to the commercialization of Avenova.

Non-cash gain on the change of fair value of warrant liability for 2019 was $0.7 million compared with a non-cash gain of $1.3 million for 2018.

Non-cash gain on the embedded derivative associated with the Convertible Note for 2019 was $0.4 million. The Convertible note was issued in March 2019 and the Company did not record a comparable loss or gain for 2018.

Other expense for 2019 was $1.4 million compared with other income of $19,000 for 2018. The other expense was due to interest due on the Promissory Note issued in February 2019, the amortization of discount and issuance cost related to the Convertible Note issued in March 2019, and the issuance cost related to issuance of warrants in August 2019.

The Company recorded a beneficial conversion feature of $0.8 million in 2019 related to the conversion of 2.7 million shares of perpetual Series A Preferred Stock into 2.7 million shares of common stock. The transaction was recorded as a discount to preferred stock and an increase to additional paid-in capital. The Company recorded no comparable transaction in 2018.

The net loss attributed to common stockholders for 2019 was $10.5 million, or $0.48 per share, compared with a net loss for 2018 of $6.5 million, or $0.39 per share.

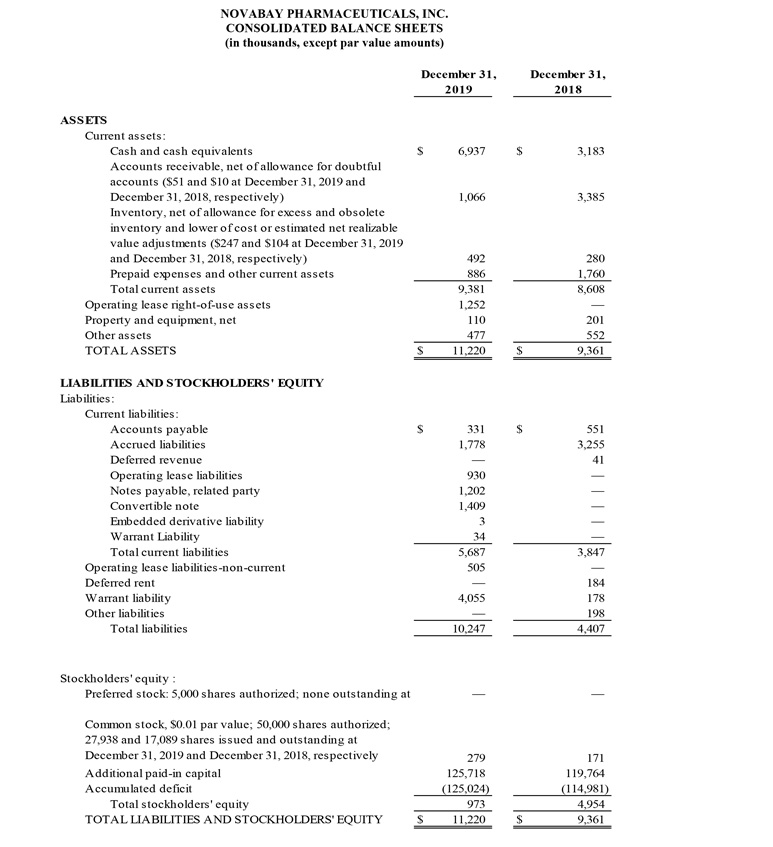

NovaBay reported cash and cash equivalents of $6.9 million as of December 31, 2019 compared with $3.2 million as of December 31, 2018. In 2019, the Company raised $1.0 million through a related-party loan in February, $2.0 million through a convertible loan in March, $2.4 million through private placements of common stock in June, $4.2 million through a registered direct offering of common stock in August and $2.7 million through a private placement of convertible preferred stock in August.

Conference Call

NovaBay management will host an investment community conference call today beginning at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss the Company’s financial and operational results and to answer questions. Shareholders and other interested parties may participate in the conference call by dialing 800-608-8202 from within the U.S. or 702-495-1913 from outside the U.S., with the conference identification number 5299253.

A live webcast of the call will be available at http://novabay.com/investors/ events and will be archived for 90 days. A replay of the call will be available beginning two hours after the call ends through 11:59 p.m. Eastern time April 13, 2020 by dialing 855-859-2056 from within the U.S. or 404-537-3406 from outside the U.S., and entering the conference identification number 5299253.

About NovaBay Pharmaceuticals, Inc.: Going Beyond Antibiotics®

NovaBay Pharmaceuticals, Inc. is a biopharmaceutical company focusing on commercializing and developing its non-antibiotic anti-infective products to address the unmet therapeutic needs of the global, topical anti-infective market with its two distinct product categories: the NEUTROX® family of products and the AGANOCIDE® compounds. The Neutrox family of products includes AVENOVA® for the eye care market, CELLERX® for the aesthetic dermatology market and NEUTROPHASE® for the wound care market. The Aganocide compounds, still under development, have target applications in the dermatology and urology markets.

Forward-Looking Statements

Except for historical information herein, matters set forth in this press release are forward-looking within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including statements about the commercial progress and future financial performance of NovaBay Pharmaceuticals, Inc. This release contains forward-looking statements that are based upon management’s current expectations, assumptions, estimates, projections and beliefs. These statements include, but are not limited to, statements regarding our business strategies and product offerings, our estimated future revenue, and generally the Company’s expected future financial results. These forward-looking statements are identified by the use of words such as “future growth,” “reduce,” and “expand,” among others. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or achievements to be materially different and adverse from those expressed in or implied by the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, risks and uncertainties relating to the size of the potential market for our products, the possibility that the available market for the company’s products will not be as large as expected, the company’s products will not be able to penetrate one or more targeted markets, revenues will not be sufficient to meet the company’s cash needs, and any potential regulatory problems. Other risks relating to NovaBay’s business, including risks that could cause results to differ materially from those projected in the forward-looking statements in this press release, are detailed in NovaBay’s latest Form 10-Q/K filings with the Securities and Exchange Commission, especially under the heading “Risk Factors.” The forward-looking statements in this release speak only as of this date, and NovaBay disclaims any intent or obligation to revise or update publicly any forward-looking statement except as required by law.

Socialize and Stay informed on NovaBay’s progress

Like us on Facebook

Follow us on Twitter

Connect with NovaBay on LinkedIn

Visit NovaBay’s Website

Avenova Purchasing Information

For NovaBay Avenova purchasing information:

Please call 800-890-0329 or email sales@avenova.com.

www.Avenova.com

NovaBay Contact

Justin Hall

President and Chief Executive Officer

510-899-8800

jhall@novabay.com

Investor Contact

LHA Investor Relations

Jody Cain

310-691-7100

jcain@lhai.com