• Avenova® unit sales set record for second consecutive quarter

• Net product revenue increased 51% for 2020

• Exited 2020 with $12.0 million in cash and equivalents

• Avenova access expanded to CVS stores and CVS online

Conference call begins at 4:30 p.m. Eastern time today

EMERYVILLE, Calif. (March 25, 2021) – NovaBay® Pharmaceuticals, Inc. (NYSE American: NBY) reports financial results for the three and twelve months ended December 31, 2020 and provides a business update.

“Avenova unit sales for the fourth quarter reached a new record, driven primarily by online orders as well as through our physician dispensed channel,” said Justin Hall, President and CEO of NovaBay Pharmaceuticals. “Product revenue for the fourth quarter increased 10% over the prior year quarter. For the full year 2020, product revenue grew an impressive 51%, which included tapping our international health supply network early in the pandemic to sell personal protection equipment (PPE) while critically important product was in short supply.

“Our focus in 2021 is on growing sales of Avenova and CelleRx® Clinical Reset™, a breakthrough product in the beauty market, which we launched late last year,” he added. “This year we have already expanded access to Avenova, which is being rolled out to CVS stores across the U.S. and was recently made available on CVS.com. We also are introducing new digital marketing programs for Avenova and CelleRx Clinical Reset that combine innovative storytelling through multiple social channels, with real-time analytics, reporting and optimization.

“Through various actions we took last year, we strengthened and simplified our balance sheet, reduced our cash burn, raised operating capital and eliminated all major debt instruments. As a result, we believe our funds are sufficient to support current operations into 2022, including our new digital marketing programs,” Mr. Hall added. “In addition to organic growth, we continue to evaluate opportunities for revenue accretion through acquisition or licensing of ophthalmic and skincare products to expand our presence in these key markets.”

Fourth Quarter Financial Results

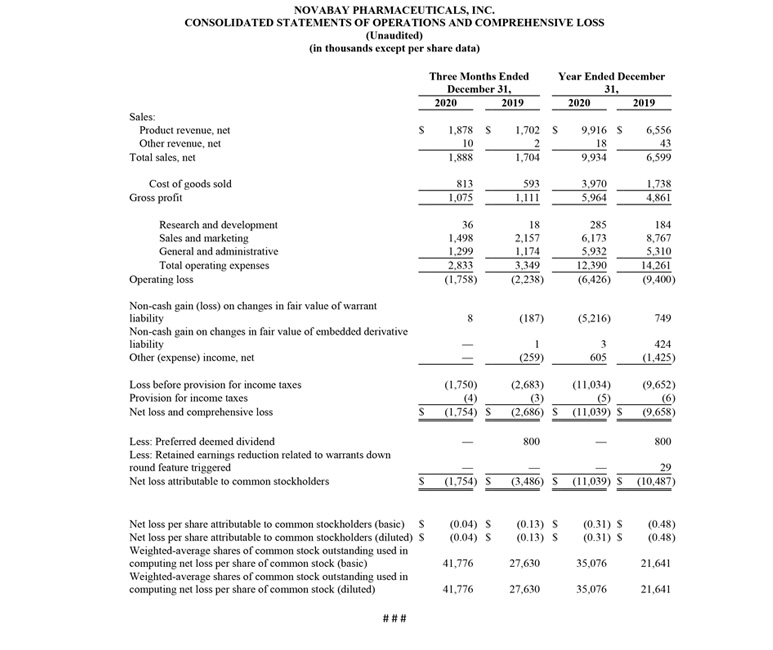

Net product revenue for the fourth quarter of 2020 was $1.9 million, a 10% increase from $1.7 million for the fourth quarter of 2019. Avenova revenue for the fourth quarter of 2020 was $1.5 million compared with $1.7 million for the fourth quarter of 2019. The decrease reflects a $0.4 million increase in a reserve for expired prescription product returns. Net product revenue for the fourth quarter of 2020 included $0.4 million in sales of NeutroPhase®, with no comparable revenue in the prior-year period.

Gross margin on total sales, net, was 57% for the fourth quarter of 2020, compared with 65% for the fourth quarter of 2019, with the decrease primarily due to the increase in the returns reserve.

Operating expenses for the fourth quarter of 2020 were $2.8 million, compared with $3.3 million for the fourth quarter of 2019. Sales and marketing expenses for the fourth quarter of 2020 were $1.5 million, compared with $2.2 million for the fourth quarter of 2019, with the decrease primarily due to lower headcount of sales representatives in the 2020 period and lower travel and related expenses due to the impact of COVID-19, partially offset by an increase in Avenova digital advertising and costs associated with the Company’s relaunch of CelleRx Clinical Reset. General and administrative (“G&A”) expenses for the fourth quarter of 2020 were $1.3 million, up slightly from $1.2 million for the fourth quarter of 2019. Research and development (“R&D”) expenses for the fourth quarter of 2020 were $36 thousand, compared with $18 thousand for the fourth quarter of 2019.

Operating loss for the fourth quarter of 2020 was $1.8 million, compared with an operating loss of $2.2 million for the fourth quarter of 2019.

Non-cash gain on the change of fair value of warrant liability for the fourth quarter of 2020 was $8 thousand, compared with a non-cash loss of $0.2 million for the fourth quarter of 2019. As of the end of 2020, the Company no longer held any warrants that will be adjusted to fair value in future periods.

Other expense, net, for the fourth quarter of 2019 was $0.3 million, which was due primarily to interest expense recognized on a convertible note. There was no comparable charge in the fourth quarter of 2020 as the convertible note was settled prior to the end of the third quarter of 2020.

The net loss attributable to common stockholders for the fourth quarter of 2020 was $1.8 million, or $0.04 per share, compared with a net loss attributable to common stockholders for the fourth quarter of 2019 of $3.5 million, or $0.13 per share.

Full Year Financial Results

Net product revenue for 2020 was $9.9 million, a 51% increase from $6.6 million for 2019. Gross margin on net product revenue for 2020 was 60%, compared with 74% for 2019.

For 2020, sales and marketing expenses decreased 30% to $6.2 million and G&A expenses increased 12% to $5.9 million. R&D expenses were $0.3 million for 2020 compared with $0.2 million for 2019.

Operating loss for 2020 was $6.4 million, a 32% improvement from the operating loss of $9.4 million for 2019.

Non-cash loss on the change of fair value of warrant liability for 2020 was $5.2 million, compared with a non-cash gain of $0.7 million for 2019.

Non-cash gain from adjustments to the fair value of an embedded derivative liability for 2020 was $3 thousand, compared with $0.4 million for 2019. The embedded derivative liability was related to a convertible note which was fully settled in September 2020.

Other income, net, for 2020 was $0.6 million, compared with other expense, net, for 2019 of $1.4 million.

The net loss attributable to common stockholders for 2020 was $11.0 million, or $0.31 per share, compared with a net loss attributable to common stockholders for 2019 of $10.5 million, or $0.48 per share.

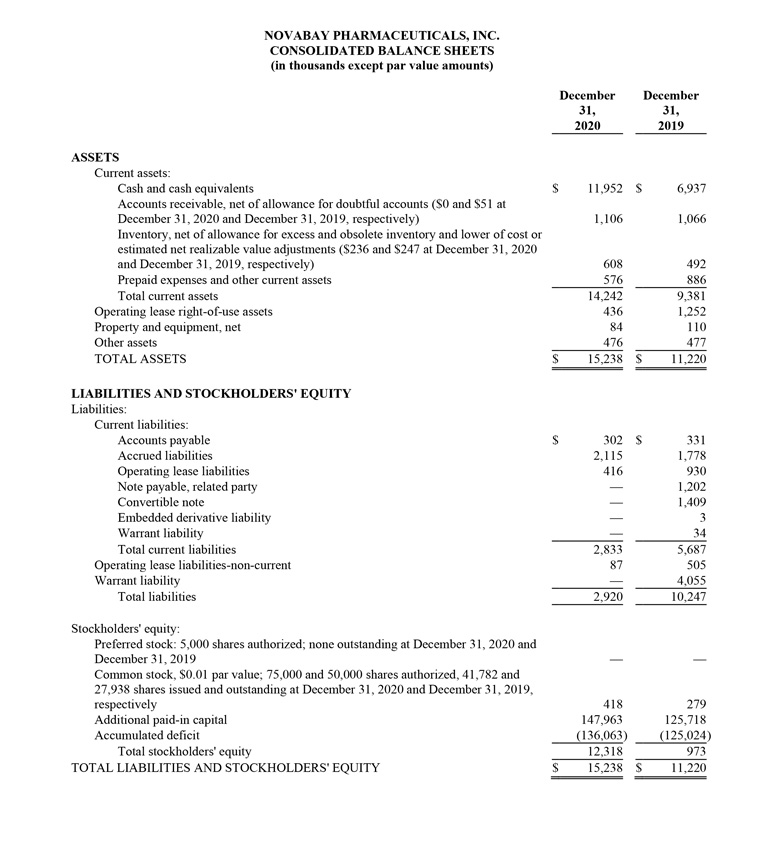

NovaBay reported cash and cash equivalents of $12.0 million as of December 31, 2020, compared with $6.9 million as of December 31, 2019. The Company raised net proceeds of $5.2 million from the sale of common stock through an ATM agreement during the quarter ended June 30, 2020 and $6.4 million from the renegotiation of warrants during the quarter ended September 30, 2020.

Conference Call

NovaBay management will host an investment community conference call today beginning at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss the Company’s financial and operational results and to answer questions. Shareholders and other interested parties may participate in the conference call by dialing 866-777-2509 from within the U.S. or 412-317-5413 from outside the U.S., and requesting the NovaBay Pharmaceuticals call.

A live webcast of the call will be available at https://novabay.com/investors/events and will be archived for 90 days. A replay of the call will be available beginning two hours after the call ends through April 15, 2021 by dialing 877-344-7529 from within the U.S., 855-669-9658 from Canada, or 412-317-0088 from outside the U.S., and entering the conference identification number 10152832.

About NovaBay Pharmaceuticals, Inc.: Going Beyond Antibiotics®

NovaBay Pharmaceuticals, Inc. is a biopharmaceutical company focusing on high-quality, differentiated, anti-infective consumer products: Avenova®, the premier antimicrobial lid and lash spray, CelleRx® Clinical Reset™, a breakthrough product in the beauty category, and NeutroPhase® Skin and Wound Cleanser for wound healing. NovaBay’s products are formulated with its patented, pure, stable, pharmaceutical grade hypochlorous acid that replicates the antimicrobial chemicals used by white blood cells to fight infection. NovaBay’s hypochlorous acid products do not cause stinging or irritation, are non-toxic and non-sensitizing, making them completely safe for regular use. Avenova is the only commercial hypochlorous acid lid and lash spray product clinically proven to reduce bacterial load on ocular skin surfaces, thus effectively addressing the underlying cause of bacterial dry eye.

Forward-Looking Statements

Except for historical information herein, matters set forth in this press release are forward-looking within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including statements about the commercial progress and future financial performance of NovaBay Pharmaceuticals, Inc. This release contains forward-looking statements that are based upon management’s current expectations, assumptions, estimates, projections and beliefs. These statements include, but are not limited to, statements regarding our business strategies and current product offerings, potential future product offerings, expanded access to our products, possible regulatory clearance of any of our products or future products, and any future revenue that may result from selling these products, as well as generally the Company’s expected future financial results. These forward-looking statements are identified by the use of words such as “launch,” “grow,” “expand,” and “continue,” among others. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or achievements to be materially different and adverse from those expressed in or implied by the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, risks and uncertainties relating to the size of the potential market for our products, the possibility that the available market for the Company’s products will not be as large as expected, the Company’s products will not be able to penetrate one or more targeted markets, and revenues will not be sufficient to meet the Company’s cash needs. Other risks relating to NovaBay’s business, including risks that could cause results to differ materially from those projected in the forward-looking statements in this press release, are detailed in NovaBay’s latest Form 10-Q/K filings with the Securities and Exchange Commission, especially under the heading “Risk Factors.” The forward-looking statements in this release speak only as of this date, and NovaBay disclaims any intent or obligation to revise or update publicly any forward-looking statement except as required by law.

Socialize and Stay informed on NovaBay’s progress

Like us on Facebook

Follow us on Twitter

Connect with NovaBay on LinkedIn

Visit NovaBay’s Website

Avenova Purchasing Information

For NovaBay Avenova purchasing information:

Please call 800-890-0329 or email sales@avenova.com

www.Avenova.com

CelleRx Clinical Reset Purchasing Information

For NovaBay CelleRx Clinical Reset purchasing information

Please call 877-CELLERX

www.CelleRx.com

NovaBay Contact

Justin Hall

Chief Executive Officer and General Counsel

510-899-8800

jhall@novabay.com

Investor Contact

LHA Investor Relations

Jody Cain

310-691-7100

jcain@lhai.com